Self-employed individuals in South Africa face unique tax challenges due to dual contribution responsibilities. Effective tax planning, aided by professional consultation, is crucial for efficient navigation of SARS obligations. Key strategies include tailoring strategies to specific circumstances, budgeting for taxes, leveraging deductions, and understanding SARS regulations. Proactive self-employment tax planning ensures better cash flow management and smoother tax seasons. This involves proper documentation, meticulous record-keeping, estimating annual income, calculating deductions, utilizing tax calculators or professional advice, staying informed about SARS incentives, and timely submission of forms like IT3 or IT14 to avoid penalties. Compliance saves time and reduces stress for business owners.

“As a South African entrepreneur, navigating tax season can seem daunting. This comprehensive checklist guides you through the essential steps for successful self-employment tax planning. From understanding unique South African taxes to identifying deductions and managing deadlines, this article equips you with the knowledge needed to optimize your financial strategy. By following these practices, ensure a smoother tax journey and potentially reduce your overall tax liability. Let’s prepare for tax season ahead, with confidence and clarity.”

- Understanding Self-Employment Taxes in South Africa

- Essential Documents for Tax Planning

- Calculating and Estimating Your Tax Liability

- Deductions and Allowances for Entrepreneurs

- Deadlines and Filing Requirements

- Useful Resources and Professional Assistance

Understanding Self-Employment Taxes in South Africa

In South Africa, self-employment taxes are a crucial consideration for entrepreneurs. As a self-employed individual, you’re responsible for paying both employer and employee contributions to the South African Revenue Service (SARS). This includes social security, old age, and medical aid funds. Effective tax planning is essential to managing these obligations efficiently. Understanding your tax liabilities and making informed decisions can help ensure compliance and potentially reduce your overall tax burden.

Consider consulting with a tax professional to tailor a strategy for your specific circumstances. They can guide you on the most efficient way to budget for self-employment taxes, take advantage of available deductions, and navigate the complexities of SARS regulations. Proactive tax planning is key to managing cash flow and ensuring a smooth tax season in South Africa.

Essential Documents for Tax Planning

Preparing for tax season is a crucial aspect of running a successful business in South Africa, especially for entrepreneurs who are self-employed. One of the most effective strategies to ensure a smooth and stress-free process is proper documentation. Before diving into the numbers, compile essential documents that will facilitate your self-employment tax planning. These include your business registration certificate, income tax returns from previous years, financial statements, and any contracts or agreements relevant to your business operations.

Additionally, keep detailed records of all business-related expenses, as these can be claimed for tax deductions. Receipts, invoices, and bank statements should be well-organized and easily accessible. With these documents in order, you’ll be better equipped to navigate the complexities of South African self-employment tax planning and maximize your potential tax savings.

Calculating and Estimating Your Tax Liability

In South Africa, self-employment tax planning is crucial for entrepreneurs to navigate the complex tax landscape effectively. As a business owner, estimating your tax liability accurately before the start of tax season can save you from unexpected financial surprises. Begin by calculating your total income for the year, including all revenue streams and sources. Then, determine your allowable deductions—from business expenses to specific allowances as per South African Revenue Service (SARS) guidelines.

Understanding these aspects is key to gauging your potential tax obligations. Using the appropriate tax calculators or consulting an accountant can help you estimate your self-employment tax liability more accurately. This proactive approach ensures that you’re prepared, compliant, and in control of your financial affairs when tax season arrives.

Deductions and Allowances for Entrepreneurs

Entrepreneurs in South Africa should be aware that there are numerous deductions and allowances available to them, which can significantly impact their tax liabilities. One of the key aspects of self-employment tax planning is understanding what expenses are taxable and what can be claimed back. This includes a range of business-related costs such as office supplies, equipment, vehicle expenses (including fuel and maintenance), insurance, and professional fees. By keeping detailed records of these expenses, entrepreneurs can ensure they receive the maximum benefits during tax season.

Additionally, the South African Revenue Service (SARS) offers various allowances to support small businesses. These may include allowances for employees, training, research and development, and capital asset purchases. Entrepreneurs should stay informed about these incentives and ensure their accounting practices reflect these deductions accurately. Effective self-employment tax planning involves staying up-to-date with SARS guidelines and taking advantage of legal deductions to optimize their tax returns.

Deadlines and Filing Requirements

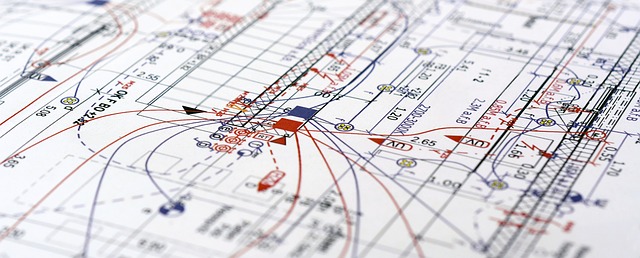

In South Africa, self-employed individuals have specific tax obligations that must be met during tax season. Deadlines for filing tax returns are crucial to avoid penalties and ensure compliance with the law. The South African Revenue Service (SARS) sets these deadlines, which typically fall between January and April each year. Entrepreneurs should be prepared to gather all necessary documentation, including income statements, receipts, and any other proof of business expenses. This thoroughness is essential for accurate tax planning and self-employment tax returns in South Africa.

Understanding the filing requirements is key to a smooth process. Different types of businesses may have varying needs, so it’s important to know which forms to complete, such as the Individual Income Tax Return (IT3) or the Business Income Tax Return (IT14). Keeping detailed records throughout the year will make the filing process easier and ensure that nothing is left out. Timely submission is equally vital to avoid delays and potential issues with SARS.

Useful Resources and Professional Assistance

Staying on top of taxes is a crucial aspect of self-employment in South Africa. To ensure smooth sailing during tax season, entrepreneurs should leverage available resources and consider professional assistance. The South African Revenue Service (SARS) offers a wealth of information on their website, including detailed guides for self-employed individuals and small businesses. These resources cover topics like revenue calculation, deductions, and important dates. Additionally, consulting with an accounting expert or tax advisor is invaluable. They can provide tailored advice based on your business structure, helping you navigate complex regulations and optimize your tax planning strategies. This proactive approach to self-employment tax planning in South Africa can save time, reduce stress, and ensure compliance.